wise county tax appraisal office

Wise County Appraisal District. Welcome to Wise County Appraisal District.

Harris County Homeowners Should Expect A Big Spike In Value On Their New Property Appraisals

Jurisdiction Base Tax Base Tax Paid Base Tax Due Penalty Interest Collection Penalty Total Due JPS HEALTH NETWORK 224 000 000 000 000 000 000 000 TARRANT.

. Wise County Appraisal District. Wise County Property Tax Appraisal. Applicant may also be.

Create a Website Account - Manage notification subscriptions save form progress and more. The method of appraisal utilized by the Wise County Assessment Team is also mandated by Virginia State Law. Please notify the Treasurers Office.

Within this site you will find general information about the District and the ad valorem property tax system in Texas as well as. Seeing too many results. You can call the Wise County Tax Assessors Office for assistance at 276-328-3556.

2021 Certified Tax Rates. Property Records Search Please note that we do not conduct Title Searches Lien Searches or Asset Searches. If requesting a search by mail the nonrefundable fee is a 10 per document.

Personal Property Tax Rate. Wise County Appraisal District. Please enclose a check or money order and address your request to.

FAQ About Property Taxes. The Wise County Tax Office collects ad valorem property taxes for Wise County and 24 additional taxing entities. Office Info.

Dallas Office By appointment only 12300 Ford. Wise CAD Official Site. Wise County Assessor Address.

Try using the Advanced Search above and add more info to narrow the. The District strictly adheres to the Texas Property Tax Code to provide equality and accurate assessments for its constituents and tax base. Office Info.

Houston Office Corporate 2200 North Loop West Suite 200 Houston TX 77018 713-686-9955. Equipment machinery and tools etc. Real-time posting of payments is temporarily paused.

Additionally the Tax AssessorCollectors office also issues tax. Wise County Appraisal District. FAQ About Property Taxes.

Wise County Appraisal District 400 East Business 380 Decatur TX 76234 Wise County Assessor Phone Number 940 627-3081 Wise County. Wise County Appraisal District. You must request a copy of a.

Find results quickly by selecting the Owner Address ID or Advanced search tabs above. It may take a few days for your balance to reflect online. All homestead applications must be accompanied by a copy of applicants drivers license or other information as required by the Texas Property Tax Code.

Wise CAD Official Site. 581-3201 states that All general reassessmentshall be made at 100. Wise CAD Official Site.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Wise County Appraisal District.

Hall County Appraisal District

How To File A Homestead Exemption In Texas Sha Hair Judge Facebook Sign Up

Tax Wise Appraisal Tax Tyler Technologies

Index Of Names From The 1925 1939 Bridgeport Index Newspaper

![]()

Appraisal District Contact Information

Wise County Messenger From Decatur Texas On March 1 1979 Page 18

Wise County Tax Assessor Collector S Office 940 627 3523 Decatur Texas

Wise County Messenger From Decatur Texas On May 15 1980 Page 13

Wise County Tx Property Search Interactive Gis Map

Welcome To The Wise County Appraisal District Website

Lamar Cad Official Site Paris Tx

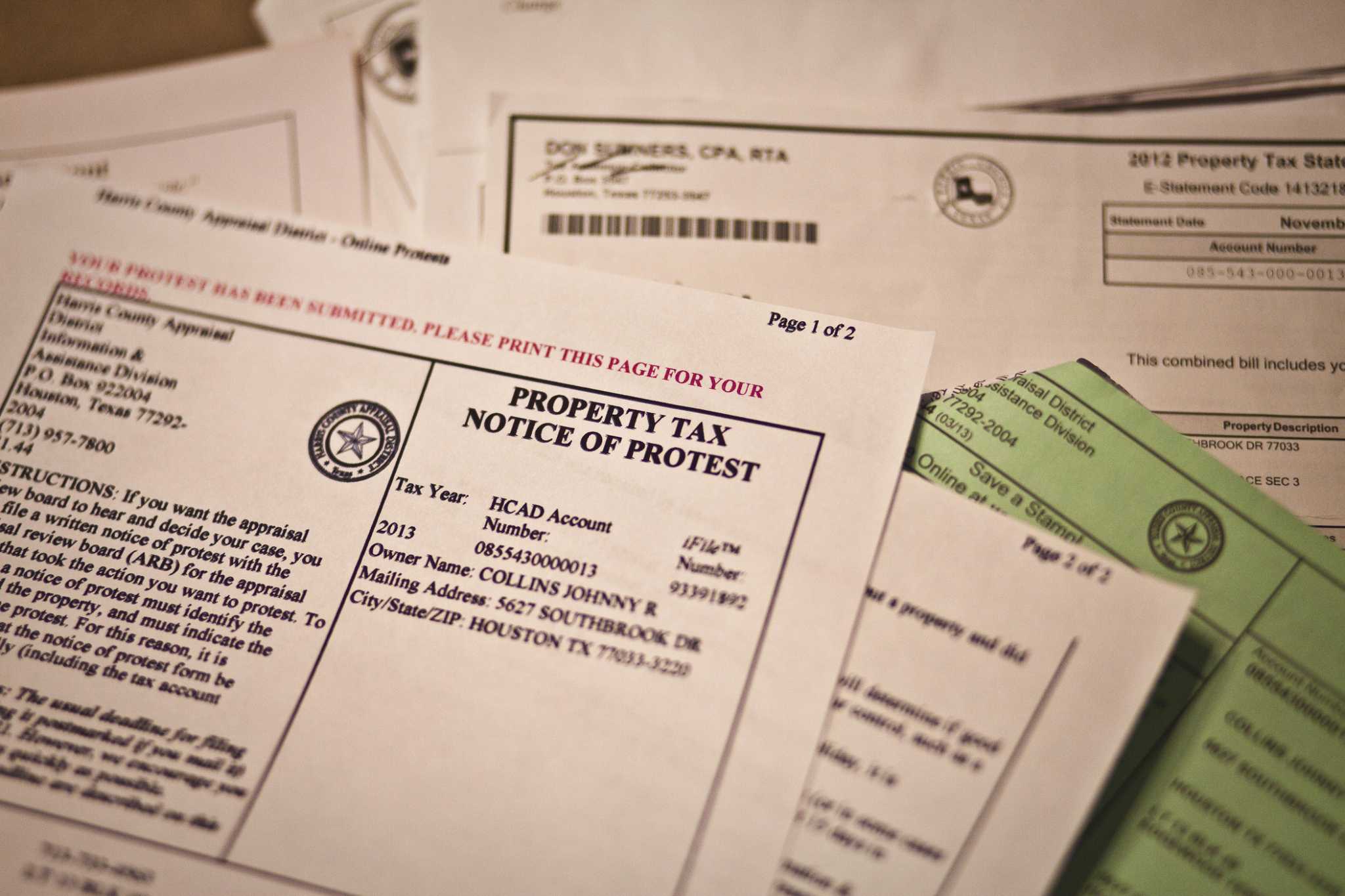

What Happens When Texans Protest Their Mind Boggling Property Taxes Texas Monthly

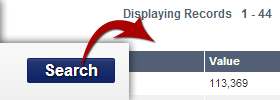

Protests Of Wise County Appraisal District Values Pays Big

Commissioner Of The Revenue Wise County Va

Lamar Cad Official Site Paris Tx

![]()

Appraisal District Contact Information

Wise County Virginia Genealogy Familysearch